Sales Cure All - NO Profit (Margin) Cures All... Beware of Shifting AI Future Though

Making a sale is awesome, right?

Back in 2015, John was struggling with his new business. Despite having a great product, he couldn't seem to get his sales to take off. He was burning through cash and felt like he was on the brink of failure.

But then, something changed. John discovered the secret to not just making sales, but making profits. And that's when everything turned around.

In this article, I'm going to share with you the top benefits of focusing on profits over sales. You'll learn how to:

- Understand the difference between gross profit margin and net profit margin.

- Implement strategies to cut costs and increase your profit margins.

- Use AI tools to optimize your business operations and stay ahead of the competition.

Ready to take your business to the next level? Click here to read the full article and discover how profits can cure all your business woes.

Avoiding AI pitfalls in your business? Begin your journey to smarter growth with Growbo. For just $1, access Growbo's platform built to simplify your business, boost efficiency, and accelerate growth—while ensuring seamless integration with your current team. Secure your spot for $1 and start optimizing your business's success.

Does Sales Cure All? (No, No It Doesn’t)

If you've ever heard the saying "Sales cure all," it's time to think again.

While a spike in sales might make your revenue charts look impressive, it's the robustness of your profits that truly determines your business's health and longevity. Let's peel back the layers on why counting your cash after costs—your profit margin—is what really counts.

Imagine your business as a bustling cafe. Each day, hundreds of customers stream through the doors. Sounds like a success story, right? But here's the catch: if each cup is sold at a razor-thin margin or at a loss to beat the competition, your register, no matter how often it rings, won’t translate into financial stability.

Instead, you might find yourself unable to cover costs or invest in quality improvements. It’s a classic case of "busy fool" syndrome—lots of activity, little actual gain.

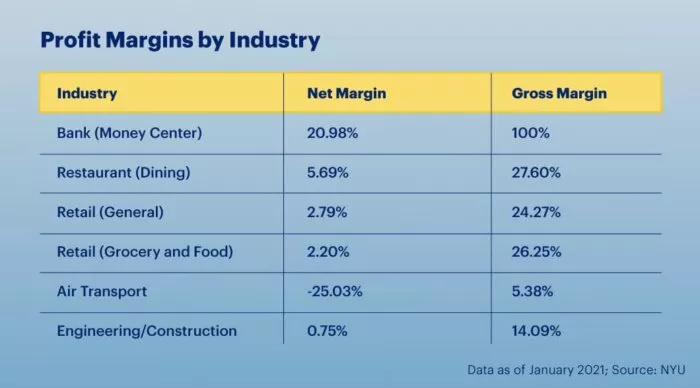

Here’s where the real magic happens: profit margins. They are the secret sauce that allows you to reinvest in your business, explore new opportunities, and buffer against economic downturns. A healthy profit margin, according to Brex, is between 5-10%. Based on the NYU study, the average net profit margin across all industries is 7.71%. This flexibility lets you make decisions that aren’t driven by cash flow desperation, like investing in better beans for your cafe or a more efficient espresso machine that speeds up service and saves costs in the long run.

Strengthening the Core

Now that we understand managing profit margin is the cornerstone of our business's financial health, how can we ensure our ability to thrive long-term?

A robust profit margin gives our business the breathing room to make decisions that aren't just about survival but about strategically steering toward sustainable growth and innovation.

Consider our journey at Growbo. Facing significant cash flow challenges, we realized that simply generating revenue wasn't enough. The real game-changer was improving the bottom line through strategic operational adjustments.

Here's how we tackled the issue:

- Expense Scrutiny: We meticulously reviewed expenses, eliminating costs that didn't contribute to client satisfaction or business growth.

- Team Optimization: We aligned team roles and responsibilities more closely with business outcomes, ensuring each effort directly supported client deliverables.

- Compensation Restructuring: We aligned compensation with company performance, motivating our team to become stakeholders in the company's profitability.

These operational tweaks transformed our business model, turning potential financial adversity into a solid foundation for future growth. This case study underscores a pivotal lesson: robust profit margins and thoughtful financial management set the stage for long-term success and innovation.

Harnessing Profitability for Strategic Growth and Innovation

Maintaining robust profit margins extends far beyond immediate financial gains. Consistent profits not only enhance operational capabilities but also enrich strategic positioning in transformative ways.

First and foremost, consistent profitability offers 'emotional freedom'—the peace of mind from financial stability, fostering better decision-making. With a healthy bottom line, we can plan with confidence, make decisions without desperation, and take calculated risks that can lead to significant advancements.

This freedom opens up numerous reinvestment opportunities, whether through dividend payouts, profit-sharing with partners, or new business initiatives. Each dollar of profit becomes a stepping stone towards greater stability and success.

Investing in new technology is another critical avenue. Artificial Intelligence (AI) stands out, reshaping how businesses operate and compete. AI integration leads to cost savings and efficiency improvements by automating routine tasks, freeing up our team for higher-value activities, and opening new business opportunities through data analysis and insights. According to the Accenture Research Study, AI has the potential that could result to an economic boost of US$14 trillion in additional gross value added (GVA) by 2035.

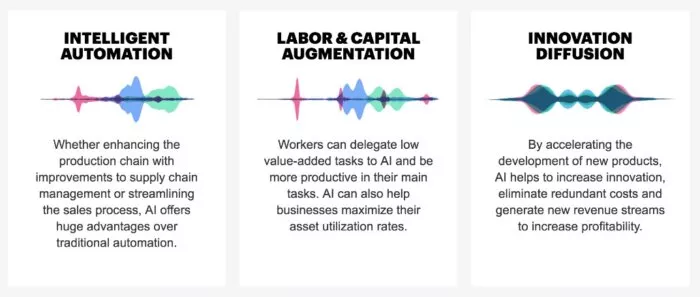

Embracing AI requires ongoing learning, healthy skepticism, and strategic planning to ensure these innovations align with long-term business goals. AI should be seen not as a challenge but as an opportunity to lead in innovation and redefine industry standards. The figure shows how AI Ai can reverse the cycle of low profitability across industries through three channels:

Future-Proofing: Communication, Adaptation, and Strategic Oversight

As we embrace profitability and integrate technologies like AI, effective communication and adaptive management within teams become paramount.

These elements are crucial for maintaining operational efficiency and ensuring business strategies align with evolving client and market needs.

Effective communication is the backbone of our operations at Growbo. Ensuring every team member is informed and engaged about changes is key to maintaining high morale and productivity. This approach not only keeps teams up-to-date but also empowers them to contribute to our evolving business strategy. Open dialogue fosters innovation and responsiveness to client needs.

Adapting to external economic conditions—whether deflation, stable pricing, or inflation—is crucial for maintaining competitiveness and profitability. At Growbo, we regularly review cost structures and pricing models to align with current market conditions and business strategies. This adaptability ensures we remain competitive without sacrificing profitability.

Strategic planning and rigorous financial monitoring are integral to our long-term success. By staying informed about market trends and continuously evaluating our financial health, we position Growbo to make informed decisions fostering growth and stability. This foresight enables us to invest in new projects, like advancing our AI capabilities, without constant financial worry.

The journey of business is about more than navigating the present; it’s about actively shaping a future aligned with our vision of delivering outstanding value to our clients. By embracing changes, whether through technology integration or strategic adaptation to economic fluctuations, we are not just responding to the market—we are leading it.

Our commitment to open communication, adaptive strategies, and proactive financial management ensures Growbo remains a resilient, forward-thinking leader ready to face future challenges. Let's continue to advance together, embracing innovation and strategic growth.

Keep Growin’, stay focused.

Image Credits

1. https://www.fastcapital360.com/blog/net-profit-margin/

2. https://blog.worldsummit.ai/how-ai-boosts-industry-profits-and-innovation